April 13th

U.S. Leather and Hide Industry 2020 Year End Review; 2021 Projections

The U.S. hides and skins market experienced further price declines throughout 2020, and export values fell compared to 2019. Although wet blue and pig skin export volume decreased, salted hide exports rose 19 percent, despite a corresponding 24 percent drop in export value. The onset of the COVID-19 global pandemic injected unprecedented uncertainty into the U.S. cattle and beef markets in the spring of 2020 and exacerbated existing market challenges faced by the animal by-products industry. The consequences were particularly acute for the U.S. hide and leather industry, which was already contending with weaker global demand and declining prices. In May 2020, steer hide values fell to likely their lowest recorded levels, before improving in the fall.

Although the expansion of the U.S. cattle herd has appeared to stall, slaughter is expected to remain relatively stable – though growing at a slightly slower pace – providing ample hides to the market in 2021. However, the U.S. industry will closely monitor the influence of macro-level factors, including the ongoing global response to COVID, the status of existing trade disputes, and the policies of the new U.S. Administration, on its ability to grow and compete in the year ahead.

Cattle Inventory

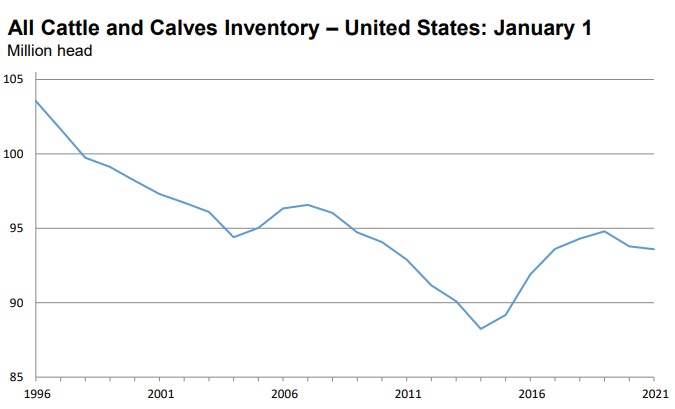

All cattle and calves in the United States as of January 1, 2021 totaled 93.6 million head, slightly below the 93.8 million head on January 1, 2020.

All cows and heifers that have calved, at 40.6 million head, were slightly below the 40.7 million head on January 1, 2020. Beef cows, at 31.2 million head, were down 1 percent from a year ago. Milk cows, at 9.44 million head, were up 1 percent from the previous year.

All heifers 500 pounds and over as of January 1, 2021 totaled 20.0 million head, slightly below the 20.0 million head on January 1, 2020. Beef replacement heifers, at 5.81 million head, were up slightly from a year ago. Milk replacement heifers, at 4.60 million head, were down 2 percent from the previous year. Other heifers, at 9.58 million head, were 1 percent above a year earlier.

Steers weighing 500 pounds and over as of January 1, 2021 totaled 16.6 million head, up slightly from January 1, 2020.

Bulls weighing 500 pounds and over as of January 1, 2021 totaled 2.21 million head, down 1 percent from January 1, 2020.

Calves under 500 pounds as of January 1, 2021 totaled 14.2 million head, down 1 percent from January 1, 2020.

Cattle and calves on feed for the slaughter market in the United States for all feedlots totaled 14.7 million head on January 1, 2021. The inventory is up slightly from the January 1, 2020 total of 14.7 million head. Cattle on feed in feedlots with capacity of 1,000 or more head accounted for 81.4 percent of the total cattle on feed on January 1, 2021, down slightly from the previous year. The combined total of calves under 500 pounds and other heifers and steers over 500 pounds (outside of feedlots) at 25.7 million head, was slightly below January 1, 2020.

The 2020 calf crop in the United States was estimated at 35.1 million head, down 1 percent from the previous year's calf crop. Calves born during the first half of 2020 were estimated at 25.8 million head, down 1 percent from the first half of 2019. Calves born during the second half of 2020 were estimated at 9.39 million head, 27 percent of the total 2020 calf crop.

Marketings of fed cattle for feedlots with capacity of 1,000 or more head during 2020 represented 87.1 percent of total cattle marketed from all feedlots in the United States, up slightly from 87 percent during 2019.

2020 Exports

The United States hide, skin and leather industry exported more than $894 million in combined cattle hides, pig skins and semi-processed leather products in 2020, representing a $276 million decrease compared to 2019.

According to U.S. Department of Agriculture data, U.S. exports of salted cattle hides reached more than $579 million in value, a 24 percent decrease from 2019 levels. Exports of wet blue cattle hides fell 25 percent in value from 2019, totaling nearly $295 million.

China was the largest buyer of salted cattle hides, with imports valued at more than $374 million, while Italy was the single largest destination for wet blue cattle hides, with imports valued at more than $88 million in 2020. Other large export markets included South Korea, Mexico, Thailand, and Vietnam.

U.S. pigskin exports declined one percent in value, totaling approximately $20.1 million for the year. Strong U.S. pigskin export growth to China stemmed more precipitous declines in overall pigskin export value, and offset smaller losses in Thailand and Mexico, the second and third largest export destinations, respectively. Together, China, Thailand, and Mexico accounted for the vast majority of all U.S. pigskin exports. However, U.S. pigskin exports to Taiwan increased significantly, rising 174 percent in 2020, totaling more than $1.36 million.

Export Numbers for U.S. Bovine Fresh/Wet Salted Hides

Number of Pieces/Thousand $U.S.

|

|

Number of Pieces |

Value Thousand $ |

||||

|

|

Jan – Dec 2019 |

Jan – Dec 2020 |

% Chg |

Jan - Dec 2019 |

Jan – Dec 2020 |

% Chng |

|

World Total |

19,980,307 |

23,831,312 |

19% |

762,977 |

579,841 |

-24% |

|

China/HK |

10,889,955 |

15,367,883 |

41% |

400,873 |

374,581 |

-7% |

|

Mexico |

2,739,390 |

4,544,987 |

66% |

96,698 |

69,692 |

-28% |

|

Korea |

3,299,381 |

1,856,196 |

-44% |

138,081 |

63,826 |

-54% |

|

Thailand |

1,249,237 |

605,189 |

-52% |

52,426 |

24,590 |

-53% |

|

EU27+UK |

480,291 |

317,492 |

-34% |

18,556 |

10,227 |

-45% |

|

Brazil |

166,314 |

237,733 |

43% |

7,695 |

8,625 |

12% |

|

Taiwan |

413,434 |

259,009 |

-37% |

16,196 |

8,076 |

-50% |

|

Indonesia |

153,818 |

156,119 |

1% |

6,994 |

5,163 |

-26% |

|

(Only Italy) |

282,012 |

154,819 |

-45% |

7,164 |

3,569 |

-50% |

|

Turkey |

44,111 |

114,678 |

160% |

1,352 |

3,320 |

146% |

|

Japan |

219,378 |

57,505 |

-74% |

12,409 |

3,265 |

-74% |

|

Vietnam |

85,577 |

106,529 |

24% |

3,165 |

3,143 |

-1% |

|

Cambodia |

44,852 |

94,573 |

111% |

1,179 |

2,395 |

103% |

|

Israel |

30,322 |

59,529 |

96% |

921 |

1,122 |

22% |

|

Canada |

7,647 |

10,861 |

42% |

703 |

619 |

-12% |

|

Ethiopia |

21,189 |

15,511 |

-27% |

676 |

416 |

-38% |

|

India |

70,542 |

12,629 |

-82% |

2,588 |

308 |

-88% |

|

Egypt |

9,325 |

6,696 |

-28% |

222 |

184 |

-17% |

|

El Salvador |

0 |

763 |

- |

0 |

58 |

- |

|

Dom. Rep. |

1,530 |

550 |

-64% |

94 |

57 |

-39% |

|

Pakistan |

576 |

1,391 |

141% |

53 |

53 |

0% |

|

Bos. & Herz. |

11,334 |

1,777 |

-84% |

787 |

52 |

-93% |

|

Argentina |

0 |

540 |

- |

0 |

22 |

- |

|

Colombia |

7,015 |

234 |

-97% |

342 |

10 |

-97% |

|

Kuwait |

56 |

2,639 |

4613% |

4 |

10 |

150% |

|

Switzerland |

0 |

107 |

- |

0 |

9 |

- |

|

Togo |

0 |

40 |

- |

0 |

8 |

- |

|

Nigeria |

119 |

37 |

-69% |

21 |

5 |

-76% |

|

Saudi Arabia |

0 |

115 |

- |

0 |

3 |

- |

Export Numbers for U.S. Wet Blue Hides

|

Number of Pieces |

Value Thousand $ |

|||||

|

|

Jan – Dec 2019 |

Jan – Dec 2020 |

% Chg |

Jan - Dec |

Jan - Dec 2020 |

% Chng |

|

World Total |

3,674,973 |

2,906,912 |

-21% |

393,353 |

294,531 |

-25% |

|

EU27+UK |

1,114,442 |

802,464 |

-28% |

123,987 |

88,065 |

-29% |

|

(Only Italy) |

1,113,235 |

802,464 |

-28% |

123,846 |

88,065 |

-29% |

|

China/HK |

987,519 |

793,922 |

-20% |

101,560 |

78,196 |

-23% |

|

Vietnam |

946,557 |

638,079 |

-33% |

103,551 |

66,835 |

-35% |

|

Thailand |

243,623 |

208,297 |

-15% |

27,342 |

22,889 |

-16% |

|

Mexico |

52,291 |

195,085 |

273% |

6,002 |

20,910 |

248% |

|

Brazil |

47,173 |

115,960 |

146% |

4,936 |

5,244 |

6% |

|

Taiwan |

201,732 |

68,524 |

-66% |

18,256 |

4,378 |

-76% |

|

Korea |

18,224 |

27,496 |

51% |

1,999 |

3,196 |

60% |

|

India |

34,119 |

22,773 |

-33% |

2,744 |

2,046 |

-25% |

|

Dom. Rep. |

10,323 |

13,391 |

30% |

1,200 |

1,557 |

30% |

|

Japan |

12,683 |

5,989 |

-53% |

1,334 |

696 |

-48% |

|

Leeward-Windward Islands |

2,315 |

14,526 |

527% |

88 |

471 |

435% |

|

El Salvador |

904 |

406 |

-55% |

105 |

47 |

-55% |

Export Numbers for U.S. Pig Skins

|

|

Number of Pieces |

Value Thousand $ |

||||

|

|

Jan – Dec 2019 |

Jan - Dec 2020 |

% Chg |

Jan – Dec 2019 |

Jan – Dec 2020 |

% Chng |

|

World Total |

2,087,783 |

2,024,479 |

-3% |

20,272 |

20,069 |

-1% |

|

China/HK |

142,189 |

916,775 |

545% |

1,200 |

7,798 |

550% |

|

Thailand |

391,644 |

344,770 |

-12% |

5,222 |

4,981 |

-5% |

|

Mexico |

1,111,012 |

407,750 |

-63% |

9,047 |

3,428 |

-62% |

|

Taiwan |

38,560 |

130,441 |

238% |

499 |

1,369 |

174% |

|

EU27+UK |

103,746 |

105,325 |

2% |

1,406 |

1,319 |

-6% |

|

Vietnam |

298,943 |

88,462 |

-70% |

2,874 |

915 |

-68% |

|

Cambodia |

0 |

28,973 |

- |

0 |

220 |

- |

|

Japan |

0 |

756 |

- |

0 |

23 |

- |

|

Ecuador |

0 |

705 |

- |

0 |

8 |

- |

|

Korea |

298 |

522 |

75% |

5 |

8 |

60% |

2021 Outlook

The expansion of the U.S. cattle herd, which began in 2014, has appeared to level off, based on the latest data available from the U.S. Department of Agriculture. This can be seen in the higher number of female cattle (cows and heifers) in the slaughter ratios toward the end of 2020, accelerating a trend from the previous year, suggesting the U.S. cattle herd expansion phase has ended. Though herd growth has likely stabilized, slaughter levels are expected to slow only slightly in the first half of 2021, yielding an adequate supply of hides available for the market.

More important in the eyes of many U.S. hides and skins suppliers, though, is the global leather demand situation, and the rise of synthetic products as alternatives to leather. The leather industry has experienced an extremely tough market in the last several years, which has been strained further by the COVID-19 pandemic. In fact, in spring 2020, U.S. steer hide value accounted for less than one percent of the entire value of the animal – likely the lowest percentage on record – after COVID-related plant shutdowns pressured the U.S. cattle and beef markets.

Despite marginal improvements in hide prices in the latter half of 2020, the industry is poised to once again contend with slumping global demand, weak prices, and disinformation campaigns that seek to intentionally mischaracterize leather’s environmental impact. Plastic synthetics and plant-based alternatives that imitate leather, but are not real leather, have taken significant market share away from the material in consumer product areas such as footwear and automobile upholstery. The situation is so dire that lower quality hides and skins are being composted and destroyed rather than processed into leather – a trend that we first reported in 2019 and has continued as market incentives to process and distribute certain hides have diminished.

Industry efforts are already underway, however, to combat the proliferation of falsehoods about leather. One such effort, “Real Leather. Stay Different.,” celebrates the versatility, beauty, sustainability, and durability of U.S. leather, and simultaneously encourages the use and purchase of real leather over synthetics by engaging brands, retailers, and consumers. The campaign unveiled an international student design contest in 2020, and recently launched the 2021 competition, after strong interest in the inaugural contest. This activity aims to position leather as the material of choice among the next generation of designers and to equip them with the knowledge and confidence to incorporate real leather in future designs.

These aforementioned initiatives complement a robust social media presence and increasing collaboration among the global leather industry to take a more proactive role in shaping leather’s story. In 2021, the U.S. industry will remain committed, in partnership with other leather industry associations, to defending leather’s sustainability in international fora. Myths concerning leather’s environmental impact have erroneously caused some designers, manufacturers, and retailers to source synthetic and other materials that often speciously boast a lower carbon footprint, when in fact, this ‘greenwashing’ only hastens environmental degradation. Dispelling these inaccuracies is an essential prerequisite to rebuilding global demand for leather in the years ahead.

The ongoing Covid-19 pandemic, though, could complicate many of these goals, as it sustains pressure on global supply chains and hampers trade, particularly in parts of Asia and Europe. Uneven vaccine distribution and onerous import restrictions present serious concerns for global trade flows and economic growth. As an export-driven industry, U.S. hides, skin and leather exports would not be spared from such disruptions, and weaker global demand from prolonged economic crises would cause the industry additional stress. At the time of this writing, trade concern in the U.S. is mounting as ocean carriers and marine terminal operators shirk guidance and levy unreasonable costs on agricultural shippers, who are grappling with exorbitant charges and are unable to obtain empty containers to export products to key foreign markets, including China. The U.S. hide, skin and leather industry is closely following these developments and is engaged in cross-sector advocacy to ensure a prompt resolution to this issue.

Assessing the situation in 2021 would be incomplete without considering the recent inauguration of Joe Biden as President of the United States. President Biden has signaled his preference for focusing on domestic issues, including reviving the U.S. economy and providing COVID relief, before turning to other issues, like trade. The new administration is currently reviewing former President Trump’s trade policies, and is paying particular attention to the U.S.’s trade dispute with China and its phase one trade agreement with the country.

President Biden is expected to pursue a multilateral approach to engaging China, leaning on traditional American allies to examine China’s trading practices and policies. Despite taking executive action to undo several of his predecessor’s initiatives, President Biden has indicated he will maintain U.S. tariffs on Chinese goods, while the review process is underway. Although the phase one U.S.-China agreement did not remove retaliatory tariffs in place, many Chinese tanners applied for, and received, tariff exemptions on U.S. hides imports, providing some relief to U.S. suppliers concerned about accessing their largest export market.

In sum, the year ahead will be busy for LHCA, as it continues to advocate on behalf of the U.S. hide, skin, and leather industry in both domestic and global settings. Part of this work includes preserving and expanding, where possible, the industry’s access to critical export markets, while defending leather against policies that seek to constrain its production or sale within the U.S. This advocacy will complement ongoing marketing, promotion, and consumer, brand, and retailer education initiatives aimed at revitalizing leather production and consumption both in the U.S. and abroad.

About LHCA

Formed by the 2020 merger of the United States Hide, Skin and Leather Association (USHSLA) and Leather Industries of America (LIA), the Leather and Hide Council of America (LHCA) is a full-service industry trade association representing the entire U.S. leather supply chain, including meatpackers, hides and skins processors, traders, leather tanners, finished leather goods producers, footwear companies, chemical suppliers, machinery producers, trade media and market reporters, freight forwarders, transportation service providers, financial institutions and more. The association provides its members with government, public relations, and international trade assistance and support. LHCA is a cooperator organization under the U.S. Department of Agriculture’s foreign market development programs, assisting U.S. firms develop new markets for U.S. agricultural exports. LHCA is at the forefront of the industry’s needs, providing members with education and technical information to compete in today’s global marketplace.