April 15th

U.S. Hide, Skin, and Leather Industry 2019 Year End Data; 2020 Projections

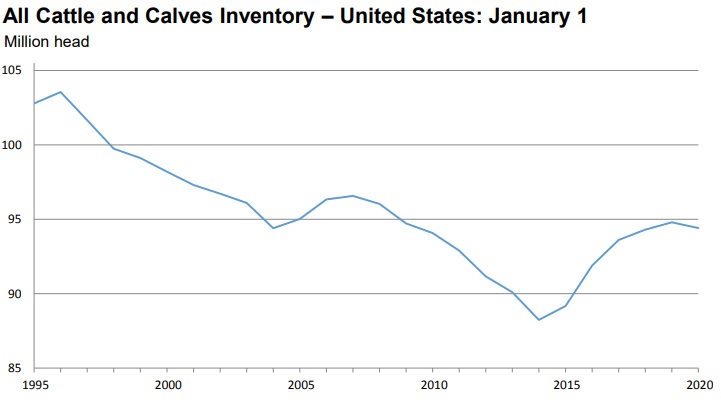

The U.S. hides and skins market experienced further price declines throughout 2019, and exports of these products declined in both volume and value compared to 2018. In addition to systemic problems in the global leather market, which pushed prices lower, the industry contended with macro-level political instability that injected significant uncertainty into the market throughout the year. Although the expansion of the U.S. cattle herd has appeared to stall, slaughter levels are expected to remain relatively stable – though growing at a slightly slower pace – providing ample hides to the market in 2020. The spread of the Covid-19 pandemic, however, may pose challenges to global supply chains.

Cattle Inventory

All cattle and calves in the United States as of January 1, 2020 totaled 94.4 million head, slightly below the 94.8 million head on January 1, 2019.

All cows and heifers that have calved, at 40.7 million head, were 1 percent below the 41.0 million head on January 1, 2019. Beef cows, at 31.3 million head, were down 1 percent from a year ago. Milk cows, at 9.33 million head, were down slightly from the previous year.

All heifers 500 pounds and over as of January 1, 2020 totaled 20.1 million head, slightly below the 20.2 million head on January 1, 2019. Beef replacement heifers, at 5.77 million head, were down 2 percent from a year ago. Milk replacement heifers, at 4.64 million head, were down 1 percent from the previous year. Other heifers, at 9.71 million head, were 1 percent above a year earlier.

Steers weighing 500 pounds and over as of January 1, 2020 totaled 16.7 million head, down 1 percent from January 1, 2019.

Calves under 500 pounds as of January 1, 2020 totaled 14.7 million head, up 1 percent from January 1, 2019.

Cattle and calves on feed for the slaughter market in the United States for all feedlots totaled 14.7 million head on January 1, 2020. The inventory is up 2 percent from the January 1, 2019 total of 14.4 million head. Cattle on feed in feedlots with capacity of 1,000 or more head accounted for 81.5 percent of the total cattle on feed on January 1, 2020, up slightly from the previous year. The combined total of calves under 500 pounds and other heifers and steers over 500 pounds (outside of feedlots) at 26.4 million head, was slightly below January 1, 2019.

The 2019 calf crop in the United States was estimated at 36.1 million head, down 1 percent from last year's calf crop. Calves born during the first half of 2019 were estimated at 26.4 million head, down slightly from the first half of 2018. Calves born during the second half of 2019 were estimated at 9.71 million head, 27 percent of the total 2019 calf crop.

Cattle and calves on feed for slaughter market in the United States for feedlots with capacity of 1,000 or more head represented 81.5 percent of all cattle and calves on feed in the United States on January 1, 2020. This is comparable to the 81.3 percent on January 1, 2019.

Marketings of fed cattle for feedlots with capacity of 1,000 or more head during 2019 represented 87.0 percent of total cattle marketed from all feedlots in the United States, down slightly from 87.1 percent during 2018.

2019 Exports

The United States hide, skin and leather industry exported more than $1.17 billion in combined cattle hides, pig skins and semi-processed leather products in 2019, representing a $450 million decrease compared to 2018.

According to U.S. Department of Agriculture data, U.S. exports of wet salted cattle hides reached nearly $762 million in value, a 30 percent decrease from 2018 levels. Exports of wet blue cattle hides fell 20 percent in value from 2018, totaling approximately $391 million.

China was the largest buyer of salted cattle hides, with imports valued at more than $400 million, while Italy was the single largest destination for wet blue cattle hides, with imports valued at more than $122 million in 2019. Other large export markets included South Korea, Mexico, Thailand and Vietnam.

U.S. pigskin exports declined 49 percent in value, totaling $20.3 million for the year. Mexico was the largest market by value for U.S. pigskins in 2019, with Thailand and Vietnam rounding out the top three destinations. Together, Mexico, Thailand, and Vietnam accounted for the vast majority of all U.S. pigskin exports. In fact, U.S. pigskin exports to Vietnam increased significantly, rising 779% in 2019, totaling more than $2.87 million.

Export Numbers for U.S. Bovine Fresh/Wet Salted Hides

|

|

Number of Pieces |

Value Thousand $ |

||||

|

|

Jan – Dec 2018 |

Jan – Dec 2019 |

% Chg |

Jan - Dec 2018 |

Jan – Dec 2019 |

% Chng |

|

World Total |

23,059,620 |

19,961,043 |

-13% |

1,093,967 |

761,888 |

-30% |

|

China/HK |

11,854,977 |

10,883,240 |

-8% |

583,171 |

400,576 |

-31% |

|

Korea |

3,671,503 |

3,293,758 |

-10% |

187,441 |

137,772 |

-26% |

|

Mexico |

3,662,079 |

2,739,390 |

-25% |

119,650 |

96,698 |

-19% |

|

Thailand |

1,787,182 |

1,247,297 |

-30% |

97,946 |

52,306 |

-47% |

|

EU-28 |

546,702 |

476,713 |

-13% |

28,715 |

18,324 |

-36% |

|

Taiwan |

436,524 |

415,814 |

-5% |

22,872 |

16,277 |

-29% |

|

Japan |

221,997 |

219,378 |

-1% |

15,443 |

12,409 |

-20% |

|

Brazil |

181,626 |

165,834 |

-9% |

11,867 |

7,689 |

-35% |

|

(Only Italy) |

302,429 |

280,840 |

-7% |

12,879 |

7,071 |

-45% |

|

Indonesia |

227,822 |

150,510 |

-34% |

10,035 |

6,789 |

-32% |

|

Vietnam |

44,476 |

85,577 |

92% |

2,172 |

3,165 |

46% |

|

India |

78,908 |

70,542 |

-11% |

2,486 |

2,588 |

4% |

|

Turkey |

128,043 |

44,111 |

-66% |

4,191 |

1,352 |

-68% |

|

Cambodia |

0 |

44,852 |

- |

0 |

1,179 |

- |

|

Israel |

47,955 |

30,322 |

-37% |

1,219 |

921 |

-24% |

|

Bos./Herz. |

55,507 |

11,334 |

-80% |

2,503 |

787 |

-69% |

|

Canada |

17,082 |

7,647 |

-55% |

1,539 |

703 |

-54% |

|

Ethiopia |

633 |

21,189 |

3247% |

41 |

674 |

1544% |

|

Costa Rica |

75,133 |

28,894 |

-62% |

1,704 |

605 |

-64% |

|

Colombia |

0 |

7,015 |

- |

0 |

342 |

- |

|

Egypt |

0 |

9,325 |

- |

0 |

222 |

- |

|

Ghana |

424 |

1,248 |

194% |

29 |

105 |

262% |

|

Dom. Rep. |

167 |

1,530 |

816% |

17 |

94 |

453% |

|

Philippines |

1,680 |

1,876 |

12% |

87 |

76 |

-13% |

|

Pakistan |

7,649 |

576 |

-92% |

263 |

53 |

-80% |

|

Djibouti |

1,457 |

550 |

-62% |

129 |

51 |

-60% |

|

Haiti |

2,720 |

349 |

-87% |

84 |

32 |

-62% |

|

Bahamas |

96 |

708 |

638% |

7 |

21 |

200% |

|

Nigeria |

83 |

119 |

43% |

19 |

21 |

11% |

|

Ecuador |

0 |

365 |

- |

0 |

16 |

- |

|

Sri Lanka |

0 |

174 |

- |

0 |

13 |

- |

|

Afghanistan |

0 |

119 |

- |

0 |

11 |

- |

|

Australia |

0 |

73 |

- |

0 |

7 |

- |

|

Guatemala |

0 |

558 |

- |

0 |

5 |

- |

|

Kuwait |

85 |

56 |

-34% |

6 |

4 |

-33% |

Export Numbers for U.S. Wet Blue Hides

|

Number of Pieces |

Value Thousand $ |

|||||

|

|

Jan – Dec 2018 |

Jan – Dec 2019 |

% Chg |

Jan - Dec |

Jan - Dec 2019 |

% Chng |

|

World Total |

4,750,944 |

3,656,472 |

-23% |

487,665 |

391,394 |

-20% |

|

EU-28 |

1,734,752 |

1,097,919 |

-37% |

178,251 |

122,258 |

-31% |

|

(Only Italy) |

1,716,374 |

1,096,712 |

-36% |

176,308 |

122,118 |

-31% |

|

Vietnam |

831,523 |

944,211 |

14% |

87,343 |

103,278 |

18% |

|

China/HK |

1,460,760 |

988,984 |

-32% |

148,394 |

101,730 |

-31% |

|

Thailand |

235,644 |

242,897 |

3% |

25,772 |

27,257 |

6% |

|

Taiwan |

190,001 |

201,732 |

6% |

17,174 |

18,256 |

6% |

|

Mexico |

72,740 |

52,291 |

-28% |

6,817 |

6,002 |

-12% |

|

Brazil |

4,865 |

47,173 |

870% |

538 |

4,936 |

817% |

|

India |

22,879 |

33,748 |

48% |

2,380 |

2,701 |

13% |

|

Korea |

31,492 |

18,224 |

-42% |

3,521 |

1,999 |

-43% |

|

Japan |

20,247 |

12,683 |

-37% |

2,073 |

1,334 |

-36% |

|

Dom. Rep. |

139,850 |

10,323 |

-93% |

14,725 |

1,200 |

-92% |

|

El Salvador |

473 |

904 |

91% |

55 |

105 |

91% |

|

Colombia |

0 |

833 |

- |

0 |

97 |

- |

|

Leeward-Windward Islands |

0 |

2,315 |

- |

0 |

88 |

- |

|

Panama |

0 |

1,111 |

- |

0 |

69 |

- |

|

Chile |

0 |

375 |

- |

0 |

44 |

- |

|

Ecuador |

0 |

749 |

- |

0 |

41 |

- |

Export Numbers for U.S. Pig Skins

|

|

Number of Pieces |

Value Thousand $ |

||||

|

|

Jan – Dec 2018 |

Jan - Dec 2019 |

% Chg |

Jan – Dec 2018 |

Jan – Dec 2019 |

% Chng |

|

World Total |

3,630,809 |

2,087,783 |

-42% |

39,894 |

20,272 |

-49% |

|

Mexico |

1,611,564 |

1,111,012 |

-31% |

13,896 |

9,047 |

-35% |

|

Thailand |

1,185,799 |

388,004 |

-67% |

18,619 |

5,208 |

-72% |

|

Vietnam |

50,608 |

298,943 |

491% |

327 |

2,874 |

779% |

|

EU-28 |

108,797 |

103,746 |

-5% |

1,765 |

1,406 |

-20% |

|

China/HK |

123,002 |

142,189 |

16% |

1,128 |

1,200 |

6% |

|

Taiwan |

354,590 |

42,200 |

-88% |

2,211 |

513 |

-77% |

|

Philippines |

0 |

826 |

- |

0 |

13 |

- |

|

Canada |

315 |

565 |

79% |

3 |

6 |

100% |

|

Korea |

40 |

298 |

645% |

3 |

5 |

67% |

2020 Outlook

The expansion of the U.S. cattle herd, which began in 2014, has appeared to level off, based on the latest data available from the U.S. Department of Agriculture. This can be seen in the higher number of female cattle (cows and heifers) in the slaughter ratios toward the end of 2019, continuing a trend from the previous year, suggesting a slowdown in growth is imminent. Though herd growth has likely leveled off, slaughter levels are expected to slow only slightly in the first half of 2020, yielding an adequate supply of hides available for the market.

More important in the eyes of many U.S. hides and skins suppliers, though, is the global leather demand situation, and the rise of synthetic products as alternatives to leather. The leather industry in general has experienced an extremely tough market for the last several years, which will likely continue in 2020. Plastic synthetic alternatives that look like leather, but are not real leather, have taken significant market share away from the material in consumer product areas such as footwear and automobile upholstery. The situation is so dire that some lower quality hides and skins are being composted and destroyed rather than processed into leather – a trend that will continue in 2020.

Industry efforts, however, are already underway to combat misinformation about leather. One such effort, “Real Leather. Stay Different.,” celebrates the versatility, beauty, sustainability, and durability of U.S. leather, while simultaneously encouraging the use and purchase of real leather over synthetics by engaging brands, retailers, and consumers.

Assessing the situation in 2020 would be incomplete without considering trade issues. In 2018, the Trump Administration levied several rounds of tariffs on imported goods from China, inviting retaliation from the Chinese and sparking a tit-for-tat trade war between the world’s two largest economies. The tariffs have not spared the hides, skins, and leather sectors, despite diligent efforts from industries in both countries.

Currently, most U.S. hides are subject to an additional 5% tariff going into China, and likewise many Chinese leather products such as sofa upholstery and small leather goods are targeted for an additional 25% duty in the U.S. Fortunately, most footwear and other major consumer products have not faced additional tariff increases, as originally planned. These goods avoided a proposed tariff increase scheduled to take effect December 15, 2019, after the U.S. and China announced the two countries reached a phase one trade agreement, which entered into force on February 14, 2020.

Although the phase one U.S.-China agreement did not remove retaliatory tariffs in place, China initiated, on March 2, 2020, a tariff exclusion process covering nearly 700 U.S. imports, including raw cattle hides larger than 16 kg (HS Code 41015019), which represent the majority of U.S. hides exports to China. At the time of this writing, many Chinese tanners have applied for, and have received, tariff exemptions on these imports, which could provide much-needed relief for the U.S. hide and leather industry.

One complicating factor this year is the Covid-19 pandemic that is placing pressure on global supply chains and hampering trade, particularly with China, but also with other parts of Asia and Europe. It is difficult to predict the exact economic impact of the virus, but it is likely to be significant, considering labor shortages recorded at ports and in manufacturing facilities abroad, compounded by an observed decline in retail traffic both globally and in the U.S. As of March 2020, the number of U.S. cases of Covid-19 continues to rise, and a growing number of states have implemented policies that require residents to stay home, thereby impacting business operations for many industries, including certain companies in the hide, skin and leather industry. The long-term implications of these measures remain unclear, but, for now, trade continues to move, though that situation could change if ports are forced to shut down, or if container availability challenges and congestion issues accelerate.About LHCA

Formed by the 2020 merger of the United States Hide, Skin and Leather Association (USHSLA) and Leather Industries of America (LIA), the Leather and Hide Council of America (LHCA) is a full-service industry trade association representing the entire U.S. leather supply chain, including meatpackers, hides and skins processors, traders, leather tanners, finished leather goods producers, footwear companies, chemical suppliers, machinery producers, trade media and market reporters, freight forwarders, transportation service providers, financial institutions and more. The association provides its members with government, public relations, and international trade assistance and support. LHCA is a cooperator organization under the U.S. Department of Agriculture’s foreign market development programs, assisting U.S. firms develop new markets for U.S. agricultural exports. LHCA is at the forefront of the industry’s needs, providing members with education and technical information to compete in today’s global marketplace.